Single Use Surgical Instruments Market Growth, Drivers, and Opportunities

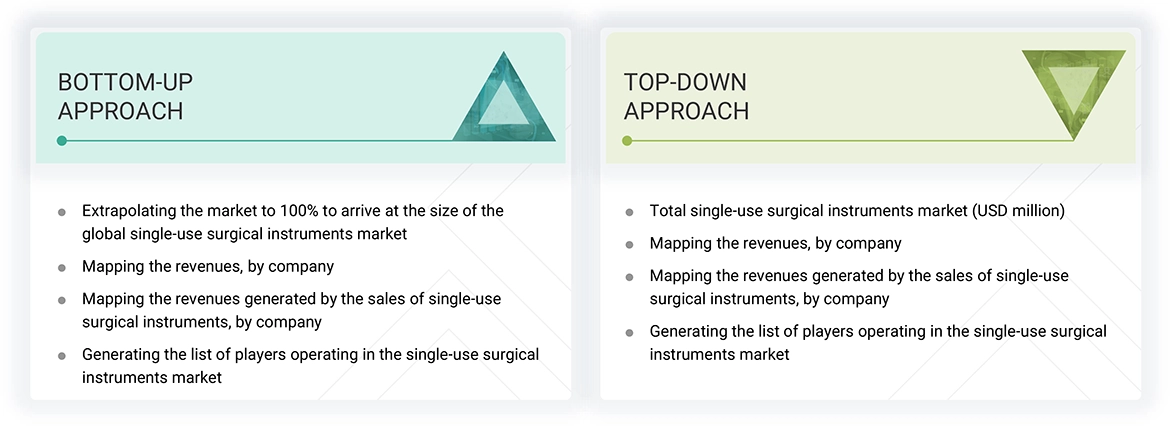

The study involved significant efforts to estimate the current size of the single-use surgical instruments market. Extensive secondary research was conducted to gather information about this market. The next step was to validate these findings, assumptions, and estimates through primary research with industry experts throughout the value chain. Various methodologies were used to calculate the total market size, including top-down and bottom-up approaches. Following this, market segmentation and data triangulation procedures were employed to estimate the sizes of the different segments and subsegments within the market.

Secondary Research

This research study extensively utilized secondary sources, including directories and databases such as Dun & Bradstreet, Bloomberg Business, Factiva, whitepapers, and company documents from public registries. The secondary research was conducted to identify and gather information for a comprehensive, technical, market-oriented, and commercial analysis of the single-use surgical instruments (SUSI) market. It aimed to gather crucial insights about the top players in the market, as well as to classify and segment the market according to industry trends, geographical areas, and key developments. Additionally, a database of the leading industry players was compiled using the data collected through secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. Supply-side primary sources included industry experts such as CEOs, vice presidents, marketing & sales directors, technology & innovation directors, engineers, and other key executives from companies and organizations operating in the SUSI market. Demand-side primary sources encompassed hospitals, clinics, researchers, lab technicians, purchasing managers, and stakeholders from both corporate and government bodies.

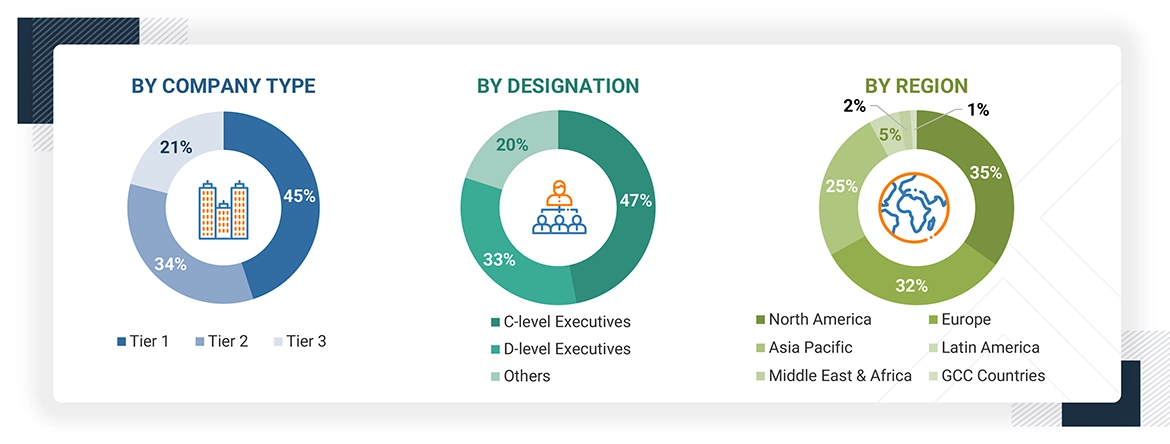

Breakdown of Primary Interviews

Note 1: C-level executives include CEOs, COOs, and CTOs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the SUSI market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

When the market size was determined, the entire market was split into three segments. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at precise statistics for all segments.

Approach to derive the market size and estimate market growth.

The market rankings of major players were determined using secondary data from both paid and unpaid sources. This analysis focused on their sales of SUSI. In some cases, due to data limitations, the revenue share was estimated after a detailed review of the product portfolios of large companies and their individual sales performance. Additionally, this information was verified at each stage through in-depth interviews with industry professionals.

Market Definition

Single-use surgical instruments are sterile medical tools designed for one-time use during procedures. Their primary purpose is to ensure safety and prevent cross-contamination. This category includes handheld instruments such as forceps, scissors, and scalpels, as well as electrosurgical instruments like cautery devices and bipolar forceps. Additionally, it encompasses endoscopic instruments, including single-use trocars and graspers, which are commonly used in minimally invasive surgeries.

Stakeholders

- Single-use surgical instrument manufacturers

- Research laboratories

- Healthcare service providers (including hospitals, ambulatory surgical centers, and specialty clinics)

- Market research and consulting firms

- Medical device suppliers, distributors, channel partners, and third-party suppliers

- Regulatory authorities

- Academic medical centers and universities

- Business research and consulting service providers

- Venture capitalists and other government funding organizations

Report Objectives

- To define, describe, and forecast the single-use surgical instruments market based on product type, application, care setting, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall single-use surgical instruments market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the single-use surgical instruments market in six regions: North America (US and Canada), Europe (Germany, the UK, France, Spain, Italy, and the Rest of Europe), the Asia Pacific (Japan, China, India, Australia, South Korea, and the Rest of Asia Pacific), Latin America (Brazil, Mexico, and the Rest of Latin America), the Middle East & Africa, and GCC Countries

- To strategically profile the key players in the global market and comprehensively analyze their core competencies

- To track and analyze competitive developments, such as product launches, expansions, agreements, and acquisitions, of the leading players in the market

link