Veterinary Surgical Instruments Market Size to Hit USD 3.10

Pune, March 05, 2025 (GLOBE NEWSWIRE) — Veterinary Surgical Instruments Market Size & Growth Analysis:

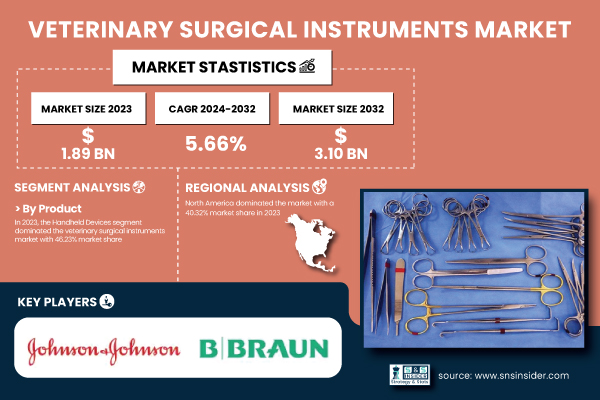

According to SNS Insider, The Veterinary Surgical Instruments Market size was valued at USD 1.89 billion in 2023 and is projected to hit USD 3.10 billion by 2032, growing at a CAGR of 5.66% from 2024 to 2032. The increasing prevalence of pet ownership, rising demand for quality veterinary healthcare, and technological advancements in surgical instruments are key drivers of market growth.

Market Overview

The veterinary surgical instruments market is witnessing a steady rise in growth with rising awareness of animal health and developments in surgical practices. The pet population, especially in urban regions, is increasing, leading to an increase in demand for surgery, especially among companion animals. Government efforts for promoting animal welfare and boosting veterinary spending are also fueling the growth of the market. Technological advances in surgical instruments, including minimally invasive instruments and imaging modalities, are improving the accuracy and efficiency of surgery. Increased demand for veterinary care, especially for small animals and livestock, is likely to further propel the market. The increasing number of pet insurance policies and veterinary practitioners is likely to drive the industry towards substantial growth during the forecast period.

Get a Sample Report of Veterinary Surgical Instruments Market@

Major Players Analysis Listed in this Report are:

- Medtronic (Harmonic Scalpel, Valleylab FT10 Energy Platform)

- Johnson & Johnson (Ethicon Endo-Surgery Staplers, Biosurgery Products)

- B. Braun Melsungen AG (Aesculap Surgical Instruments, Surgical Sutures)

- Olympus Corporation (Olympus Surgical Endoscopes, EndoTherapy Devices)

- Integra LifeSciences (Integra LifeSciences Surgical Instruments, Sutures)

- Stryker Corporation (Stryker Endoscopy Devices, Surgical Instruments)

- KLS Martin Group (KLS Martin Surgical Instruments, Electrosurgical Equipment)

- Henry Schein Animal Health (Veterinary Surgical Instruments, Sutures)

- Baxter International (Baxter Surgical Instruments, Hemostats)

- Smith & Nephew (Endoscopy Instruments, Surgical Sutures)

- Thermo Fisher Scientific (Sterile Disposable Syringes, Surgical Gloves)

- Medi-USA (Veterinary Surgical Tools, Surgical Scalpels)

- Richmond Veterinary Supplies (Surgical Scalpels, Needles & Sutures)

- JorVet (Veterinary Surgical Instruments, Dog & Cat Surgery Packs)

- VetEquip, Inc. (Veterinary Surgical Instruments, Anesthesia Equipment)

- Surgical Direct (Veterinary Surgical Instruments, Electro-surgical Units)

- Ralphs Farm Supplies (Surgical Instruments, Animal Spay & Neuter Kits)

- VetTech (Veterinary Forceps, Scalpels & Surgical Blades)

- Surgical Specialties Corporation (Suture Needles, Surgical Sutures)

- DRE Veterinary (Surgical Instruments, Endoscopic Equipment)

Veterinary Surgical Instruments Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.89 billion |

| Market Size by 2032 | US$ 3.10 billion |

| CAGR | CAGR of 5.66% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | Increased Demand for Quality Veterinary Healthcare and Cutting-Edge Surgical Innovations. |

Segment Analysis

By Product

The Handheld Devices segment dominated the market in 2023, with a market share of 46.23% of the overall market. The reason behind the dominance of this segment is the widespread utilization of surgical forceps, needle holders, and scissors in regular and complicated procedures. These tools play a significant role in executing accurate surgeries in different veterinary specialties.

The Electrosurgical Instruments segment is likely to grow at the highest rate as there is growing preference for minimally invasive procedures. These instruments are precise, cause less tissue damage, and result in quicker healing, and as a result, more and more veterinarians are increasingly looking for them.

By Animal

The Small Animals segment dominated the market with a 68.41% share in 2023. The increasing rate of pet adoptions, combined with growing concern for pet healthcare, has fuelled demand for surgical procedures among cats and dogs. Moreover, the increasing accessibility of sophisticated surgical procedures and veterinary clinics that cater to small animal care is contributing to market growth.

The Large Animals segment is anticipated to see strong growth. The demand for veterinary services among livestock, equine, and exotic animals is fueling the demand for high-tech surgical equipment to enhance animal welfare and productivity in agriculture.

By Application

The Dental Surgery segment held the highest share in 2023. Growing concern for pet oral health and the incidence of periodontal disease in small animals have resulted in an increase in veterinary dental treatments. The segment is expected to continue its leadership position owing to continuous advancements in dental surgical instruments.

The Orthopedic Surgery segment is expected to grow immensely because of the increasing number of bone fractures and joint diseases among pets. As surgical methods improve and implants become more advanced, veterinarians can now provide enhanced results, which is driving demand in this segment.

By Purchasing Channel

The Online Sales segment was market leader in 2023. The growing popularity of e-commerce platforms for use with veterinary instruments has increased the market’s efficiency and accessibility, with pet owners and veterinarians preferring direct purchases online owing to cost savings and product variety.

The Direct Sales to Veterinary Clinics segment is likely to experience the highest growth. Veterinary clinics and hospitals are increasingly opting for direct purchase from manufacturers for cost benefits and quality assurance, leading to this segment’s quick expansion.

By End Use

The Veterinary Hospitals segment was the leading one in terms of market share in 2023 due to the rising veterinary hospitals across the globe and the capability of offering advanced surgical procedures. Improved infrastructure, qualified individuals, and accessibility of advanced surgical tools are critical determinants bolstering this segment’s leadership position.

The Ambulatory Surgical Centers segment is expected to expand at a high growth rate. These centers offer affordable and effective surgical options, providing specialized outpatient procedures that are increasingly popular among pet owners and veterinarians.

Need any customization research on Veterinary Surgical Instruments Market, Enquire Now@

Veterinary Surgical Instruments Market Segmentation

By Product

- Handheld Devices

- Forceps

- Scalpels and Blades

- Surgical Scissors

- Hooks & Retractors

- Trocars & Cannulas

- Clamps/Hemostats

- Others

- Electrosurgery Instruments

- Sutures, Staplers, And Accessories

- Other

By Animal

- Large Animals

- Equines

- Other Large Animals

- Small Animals

- Canines

- Felines

- Other Small Animals

By Application

- Soft Tissue Surgery

- Sterilization Surgery

- Gastrointestinal (GI) Surgery

- Dental Surgery

- Orthopedic Surgery

- Ophthalmic Surgery

- Other applications

By Purchasing Channel

- Online Sales

- Offline Sales

By End Use

- Veterinary Hospitals

- Veterinary Clinics

- Others (Research Institutes & Academia, Pathology/Diagnostic Laboratories)

Regional Analysis

North America dominated the veterinary surgical instruments market with a 40.32% share in 2023. The region’s established veterinary healthcare infrastructure, growing pet ownership, and higher expenditure on pet care are major drivers of market leadership.

Asia-Pacific is expected to record the fastest development over the prediction period. Enhanced pet adoption, urbanization at a faster pace, and advancements in veterinary care facilities within economies like China, India, and Japan are stimulating market growth.

Recent Developments

- December 2024 – B. Braun Vet Care introduced a new line of advanced electrosurgical instruments for veterinary use, enhancing precision in soft tissue surgeries.

- October 2024 – Medtronic launched a portable veterinary surgical laser system designed to improve efficiency and reduce post-operative complications.

- August 2024 – IDEXX Laboratories announced the expansion of its veterinary surgical instruments portfolio with innovative orthopedic solutions for companion animals.

- July 2024 – Jorgensen Laboratories launched a new range of minimally invasive surgical instruments tailored for exotic animal procedures.

Statistical Insights and Trends Reporting

- The veterinary surgical instruments market witnessed a 12.5% increase in demand for minimally invasive surgical tools in 2023.

- In 2023, global spending on veterinary surgeries reached approximately USD 9.2 billion, highlighting the growing emphasis on animal healthcare.

- The number of registered veterinary surgeons specializing in surgical procedures grew by 7.8% in 2023, emphasizing the industry’s expansion.

Buy a Single-User PDF of Veterinary Surgical Instruments Market Analysis & Outlook Report 2024-2032@

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Usage and Adoption Trends (2023)

5.2 Market Penetration and Sales Trends (2023), by Region

5.3 Veterinary Surgical Instruments Procurement & Distribution Trends (2020-2032), by Region

5.4 Veterinary Healthcare Spending by Region (2023

5.5 Innovation & Technological Advancements in Veterinary Surgical Instruments (2023)

6. Competitive Landscape

7. Veterinary Surgical Instruments Market by Product

8. Veterinary Surgical Instruments Market by Animal

9. Veterinary Surgical Instruments Market by Application

10. Veterinary Surgical Instruments Market by Purchasing Channel

11. Veterinary Surgical Instruments Market by End Use

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

Access Complete Report Details of Veterinary Surgical Instruments Market Analysis & Outlook 2024-2032@

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

link